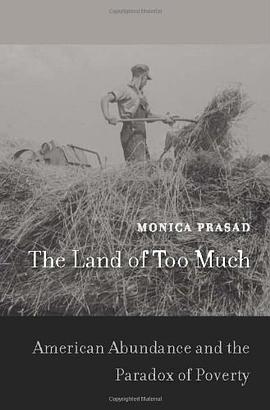

The Land of Too Much

内容简介

The Land of Too Much presents a simple but powerful hypothesis that addresses three questions: Why does the United States have more poverty than any other developed country? Why did it experience an attack on state intervention starting in the 1980s, known today as the neoliberal revolution? And why did it recently suffer the greatest economic meltdown in seventy-five years? Although the United States is often considered a liberal, laissez-faire state, Monica Prasad marshals convincing evidence to the contrary. Indeed, she argues that a strong tradition of government intervention undermined the development of a European-style welfare state. The demand-side theory of comparative political economy she develops here explains how and why this happened. Her argument begins in the late nineteenth century, when America's explosive economic growth overwhelmed world markets, causing price declines everywhere. While European countries adopted protectionist policies in response, in the United States lower prices spurred an agrarian movement that rearranged the political landscape. The federal government instituted progressive taxation and a series of strict financial regulations that ironically resulted in more freely available credit. As European countries developed growth models focused on investment and exports, the United States developed a growth model based on consumption. These large-scale interventions led to economic growth that met citizen needs through private credit rather than through social welfare policies. Among the outcomes have been higher poverty, a backlash against taxation and regulation, and a housing bubble fueled by "mortgage Keynesianism." This book will launch a thousand debates.

......(更多)

作者简介

Monica Prasad is Associate Professor of Sociology and Faculty Fellow in the Institute for Policy Research at Northwestern University.

......(更多)

目录

List of Figures* and Tables**

Preface

Part I. Explaining American State Intervention

1. The Farmers’ Tour

2. Comparing Capitalisms

3. A Demand-Side Theory of Comparative Political Economy

Part II. The Agrarian Regulation of Taxation

4. The Non-History of National Sales Tax

5. The Land of Too Much

6. Progressive Taxation and the Welfare State

Part III. The Agrarian Regulation of Finance

7. American Adversarial Regulation

8. The Democratization of Credit

9. The Credit/Welfare State Trade-Off

Part IV. Conclusion

10. American Mortgage Keynesianism: Summary and Policy Implications

Notes

References

Acknowledgments

Index

* Figures:

2.1 Pre-tax and transfer inequality and post-tax and transfer inequality

3.1 Index of industrial production, 1870–1912

3.2 Index of agricultural output, 1869–1950

3.3 Index of manufacturing output, 1869–1941

3.4 Total GDP, 1820–1924

3.5 Wholesale commodity price index, 1848–1943

3.6 U.S. mortgage interest rates, 1869–1885

3.7 Index of agricultural output, 1889–1929

3.8 “How to see our wheat”

7.1 Restrictiveness of banking regulation before 1999

8.1 Index of activity in the building industry, 1925–1929 and 1932

10.1 Argument of the book

** Tables:

1.1 The United States compared to other industrialized countries

3.1 GDP per capita

4.1 Regional voting on sales tax in Congress, November 3 and 4, 1921, Republicans only

4.2 Regional preferences for sales tax in Congress, 1932

8.1 Regional voting on McFadden Act in House of Representatives, February 4, 1926

9.1 The demand for credit, 1980–2005

9.2 The effect of deregulation on credit for different levels of social spending

......(更多)

读书文摘

......(更多)