内容简介

在线阅读本书

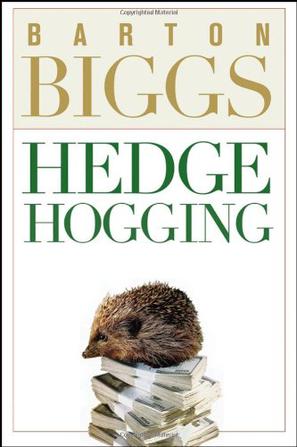

Praise for HedgeHogging "Barton Biggs writes about markets with greater style, clarity, and insight than any other observer of the Wall Street scene. His new book, Hedgehogging, entertains immensely even as it provides countless valuable lessons regarding hedge funds and the investment world they inhabit."

—David F. Swensen, Chief Investment Officer, Yale University "Since the glory days of the tech bubble, investing has become a perilous enterprise. Not the least for those running money in the proliferating hedge fund business. In Hedgehogging, Biggs offers a fascinating glimpse behind the scenes at the personalities and egos making decisions about the enormous sums being dumped en masse into these funds. This book is great. It's full of personal anecdotes and critical insights from an insider's insider. You should not even consider giving money to anyone on Wall Street ever again until you've read this book."

—Addison Wiggin, Agora Financial LLC, author of the New York Times bestseller, The Demise of the Dollar and coauthor of Empire of Debt Rare is the opportunity to chat with a legendary figure and hear the unvarnished truth about what really goes on behind the scenes. Hedgehogging represents just such an opportunity, allowing you to step inside the world of Wall Street with Barton Biggs as he discusses investing in general, hedge funds in particular, and how he has learned to find and profit from the best moneymaking opportunities in an eat-what-you-kill, cutthroat investment world.

......(更多)

作者简介

巴顿·比格斯在摩根士丹利工作了30年,曾任该公司的首席战略官。在此期间,他创立了摩根士丹利的研究部,并使之成为世界上最优秀的投行研究部门。他还曾一手创办公司的投资管理业务部,并担任其主席达30年之久。到20世纪90年代中期,摩根士丹利投资管理部每年赢得的新客户超过任何竞争对手。

比格斯多次被《机构投资者》杂志评选为“美国第一投资策略师”;1996年到2003年,他一直在全球投资策略师评比中名列前茅。2003年6月,比格斯离开摩根士丹利,与两位同事共同发起了Traxis合伙基金,那是2003年规模最大的新发对冲基金。如今,Traxis管理的资金超过10亿美元。

......(更多)

目录

......(更多)

读书文摘

......(更多)